Date posted: 14th Dec 2022

I still get asked on many occasions, to comment on whether a business should be operated as a limited company, usually from a tax perspective.

The general answer is usually “it depends” and it genuinely does depend upon a number of factors (some of which are commercial), such as the requirement for limited liability, whether the company undertakes R&D, whether the profits will be drawn in full, whether the business looks bigger to potential clients as a limited company and so forth.

In terms of tax though, these days, answer isn’t always yes as frequently.

Why?

For many years, there were many tax advantages of being a limited company and once a certain profit threshold had been breached, the answer was almost always yes – not that this was always advisable as some clients struggled to keep the paperwork in order being a sole trader, let alone the additional work required to operate a limited company. In addition, some clients struggled to realise that the company monies were not their personal monies and this leads to another host of tax issues.

In 2016, the landscape altered when the notional tax credits associated with dividends were abolished, thus driving up an increase in the tax rates applied to dividend income. Since then we have seen further increases in the dividend tax rates and further increases in corporation tax rates. Also, for “one man band” limited companies, the recent changes in IR35 rules have moved the goalposts somewhat as the decision as to whether IR35 applies or not is no longer made by that company but instead by the main contractor.

What is the tax saving?

When you consider whether incorporation is financially viable, as a starting point, you need to look at the tax and national insurance position of the individual as a sole trader, compared against the position of the individual as a director-shareholder and the position of the company.

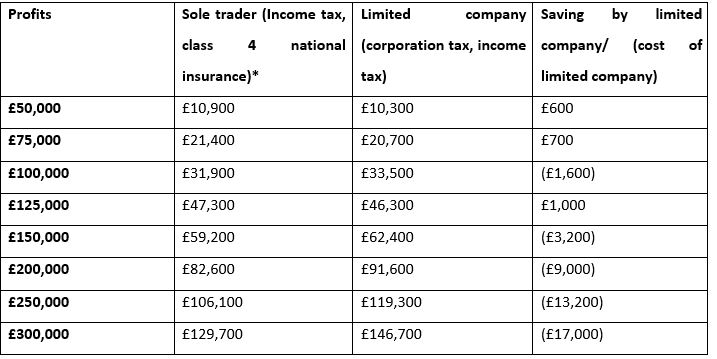

The overall tax positions on differing levels of profits, is as follows:

*There is also a flat rate class 2 national insurance to consider – c£160

There are a number of assumptions here – some of which are a) we are assuming all profits are drawn, b) a minimum salary to qualify for state pension credits is taken, c) the employment allowance is not available, d) there is no R&D relief, e) the individual has no other income etc.

So the above figures give a general guide but should not be substituted for proper tax planning advice especially as a) is a huge assumption.

The headline cases that do suggest that there is an overall saving in some instances but then you need to bear in mind that operating as a limited company will mean that there will be additional professional costs as it costs more in fees to operate as a limited company than a sole trader. This includes cost involved in preparing more detailed accounts, running a payroll and submitting additional returns to both Companies House and HMRC.

Guide only

There are various reasons why the above figures should be used as a guide only.

The main one being that they assume all the profit is withdrawn which is not the case with many companies. Pension contributions can be a valuable method of extracting profits with no personal tax implications for the director-owner and tax relief for the company.

In addition, the calculations assume a sole director-shareholder but if the company could be set up with a spouse or civil partner then including two personal allowances, two basic rate bands and two dividend allowances in the numbers, could still yield large tax savings.

Although when deciding whether to incorporate it should not be forgotten that there are other vehicles of operation that may produce higher tax savings in comparison. A partnership could be a more tax-efficient option for those who are married or civil partners because of the availability of double personal allowance and double basic rate band (assuming that there is no other income). However, bearing in mind the protections offered as a company may lead the owner to look at setting up a limited liability partnership (“LLP”) rather than an ordinary partnership.

There are also a number of commercial factors to consider, as I said at the outset.

Disincorporation

If you are already operating as a limited company and profits are dwindling etc then you may be able to move the business back to a sole trader, partnership or LLP.

You will need to consider the tax issues of moving the assets from the company as these belong to the company and therefore if the company has valuable assets, there can be a whole host of tax consequences, particularly in relation to goodwill.

Essentially, goodwill is the value of the business over and above the value of its physical assets. A lot of businesses that were incorporated many years ago (and some now) will sell the goodwill value to the company in return for a directors loan account credit. Tax is paid upon the goodwill but in historic cases, that may have been as low as 10%. In the reverse situation, the director will need to buy the goodwill from the company and create a tax charge in the company upon the market value. If the director cannot afford to buy the goodwill, then there could be tax consequences of a loan owed to the company by the director. However, if the trade is dwindling (or perhaps there is no goodwill as the goodwill is associated with the individual rather than company), then there may be little value to any goodwill. However, “never say never” as it is an area that needs to be explored properly.

Finally, there is an ongoing consultation in relation to whether a private company needs to publish it’s profit and loss account at Companies House. At the moment, there is very little information provided on the public record (for smaller companies) but having such information made publicly available, could again mean that more businesses consider disincorporation.

As ever, if you need advice in this area, please contact the team here.