Date posted: 9th Dec 2024

After the significant increase in employer’s national insurance in the Budget, a lot of attention is, naturally, being given by businesses to how they can minimise the impact.

One of the options that businesses are considering is known as salary sacrifice. This option has the added benefit that employees pay lower amounts of national insurance and income tax.

Salary sacrifice

Given that these schemes can take time to implement, it is important that well in advance of April 2025, employers review their current salary packages and consult with employees.

In simple terms, salary sacrifice means that the employee gives up salary in return for the provision of another benefit, that is either tax free or produces a lower tax charge.

Care is needed with ensuring that the national minimum wage obligations are still met and ensuring that the employee understands that their income will be reduced, which means that their ability to say borrow to buy a house is reduced. There may also be an impact on certain insurance products were these are linked to an individual’s salary.

Commercially businesses will have to be careful that they get message across about the employment package rather than just the salary element, be that for recruitment or retention.

The three main options that HMRC approve are:

- Low emission vehicles.

- Workplace childcare.

- Employer pension contributions.

Concentrating on the latter, a significant number of employers help facilitate employees making a personal tax pension contribution, possibly with an employer top up. An alternative is for the employer to make the pension payment – The payment by an employer of a pension contributions for an employee, does not produce a tax charge for the employee, although care is needed around annual allowances for certain individuals. Changing from an employee to an employer pension contribution may provide an opportunity to save some national insurance for both employee and employer.

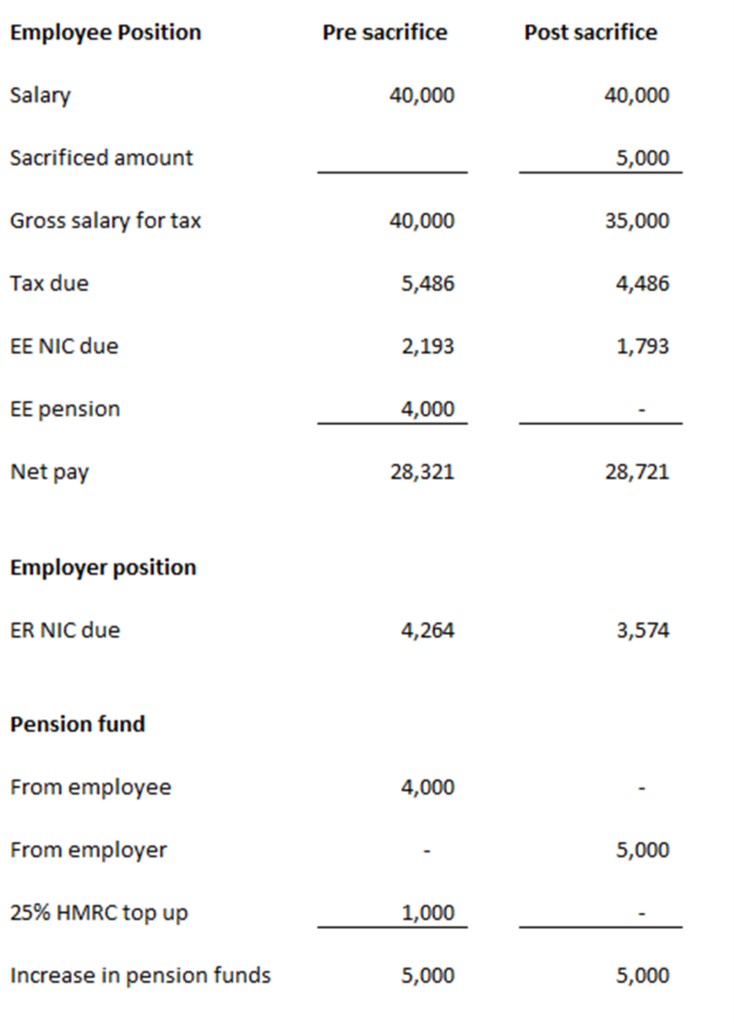

If we take the example of a basic rate taxpayer earning £40,000 for 2024/25. The individual may pay 10% (£4,000) into their private pension scheme, from their net pay. That £4,000 becomes £5,000 with the HMRC top up for personal pension contributions. Instead, you can offer them the chance to salary sacrifice those pension contributions by asking them to give up £5,000 of salary in return for employer contributions. This means that not only will the employee save some national insurance, but the employer will too. The worked example for 2024/25:

In the above example the employee is £400 per annum better off, and the employer is £690 better off.

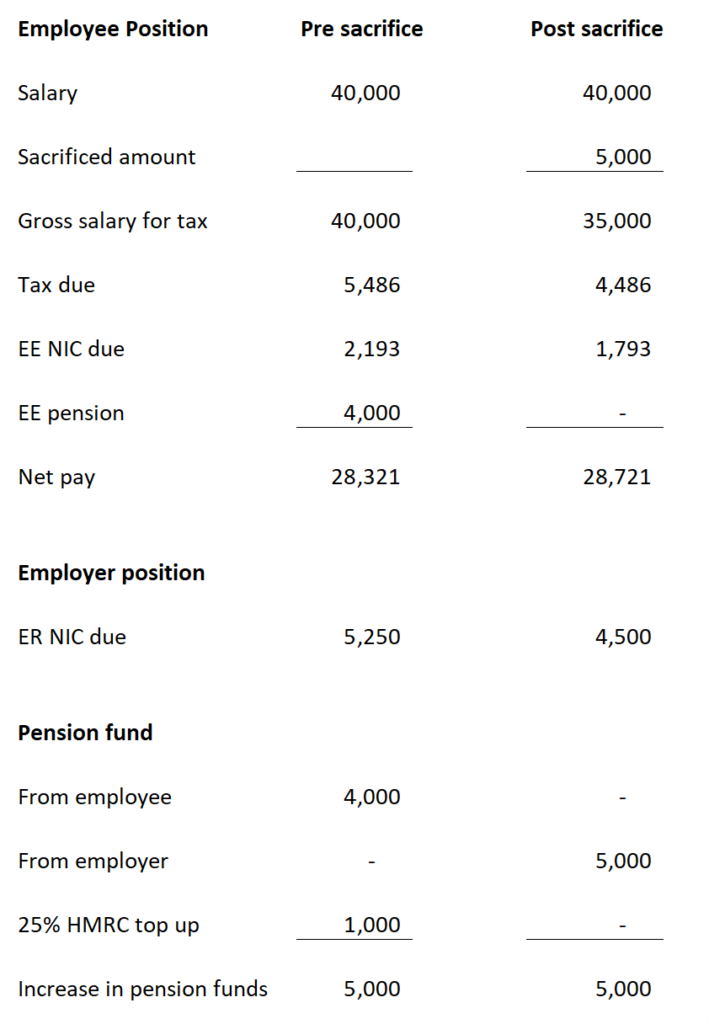

The saving will increase further for 2025/26, when the employer national insurance rates increase, as shown below (albeit the overall charge increases due to the decrease in the employer’s threshold):

Important – Whilst the tax situation does not alter, the way of claiming tax relief does, so care is needed around the payroll processing to ensure that there is no accidental doubling up of relief.

Tax free benefits

Aside from salary sacrifice, there are other options to save tax and national insurance, which could be given instead of a pay rise or to compensate for a lower pay rise.

It is important to review your benefits package and consider:

- Offering the employee the opportunity to divert any bonuses into pension.

- Awarding more holidays or allowing staff to buy holidays by giving up salary in return for additional holidays.

- Increasing employer pension contributions. Perhaps from some of the national insurance savings in the example(s) above?

- Providing free car parking if you do not already – perhaps buy some passes at a local car park?

- Providing staff with mobile phones which are a tax-free perk as long as the company contracts with the operator.

- Providing cycles and equipment if the employee cycles to work.

- Providing long service awards.

- Rewarding staff for new suggestions.

- Providing staff with specific welfare counselling.

- Providing staff with an annual health screening assessment.

- Paying for eyes tests where a VDU is required as part of normal duties.

- Providing training to staff, for example paying for a leadership development courses.

- Increasing mileage allowances rates paid to employees, if you do not reimburse at the HMRC rates.

- Paying professional subscriptions where these are not already reimbursed.

- Putting in place group income protection or group life insurance policies.

It is important to also review the cost of existing benefits packages. As prices increase it may be worthwhile reviewing the scope of such benefits, to reduce employer costs.

Certain trivial benefits can be made tax free but cannot be part of any sacrifice schemes – see https://www.cliveowen.com/2024/07/trivial-benefits-they-arent-taxable-are-they/ for the conditions to be met.

A bit of help?

Finally, it is important to remember that there is going to be an increase in the employer’s allowance, from April 2025, to £10,500 (from £5,000) and that this will also be available to most employers too. The increases in national insurance are also allowable costs when calculating profits and tax so this could give some further tax relief of up to 26.5% for companies or up to 47% relief for unincorporated businesses.

With that in mind, maybe it is time to consider your choice of trading entity, given that recent tax changes have narrowed the tax benefits of being incorporated. Although there are a host of other reasons to be incorporated, including limited liability protection and other considerations. That is an entirely separate blog…