The personal allowance will remain the same at £12,570 per annum and the standard tax code will be 1257L. The Emergency code will be 1257L week1/month1.

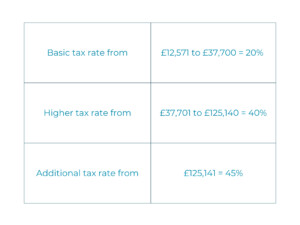

Please find below the English Income tax bands of taxable income per year:

Tax codes can change due to the individual’s circumstances as they may have tax relievable expenditure to claim or they may receive benefits in kind such as company cars, gym memberships, medical insurance etc. If they earn over £100,000, then the personal allowance is gradually withdrawn.

Please find below the Scottish Income tax bands of taxable income per year:

CALL US 01325 349700

Lines open 8.30am-5.00pm Mon-Fri

Join our mailing list today for insights, events and webinars: