National Living Wage and National Minimum Wage rates will increase from 1 April 2025 and changes must be implemented from the first “pay reference period“ from 1st April 2025.

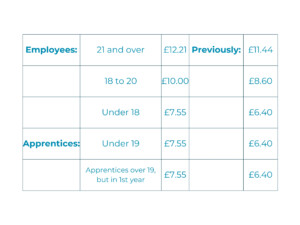

The new rates per hour are as follows:

Please note that the apprenticeship rate only applies to apprentices aged under 19 and those over 19 who are in the first year of their apprenticeship. Apprentices aged 19 or over in their second year of apprenticeship must receive the NLW / NMW that their age entitles them to.

We will review the rates used based on the information we hold on our files. However, this will be on the assumption that we hold correct data and therefore we would advise you to cross check your own employees. Should you have any employees who are paid over the NMW we will not make any changes unless advised by yourselves.

We would be grateful if you would review the ages of your employees ensuring that they are on the correct rate for their age. If they are not, then please advise us accordingly.

Please note:

CALL US 01325 349700

Lines open 8.30am-5.00pm Mon-Fri

Join our mailing list today for insights, events and webinars: