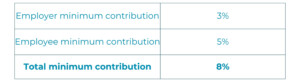

The minimum contributions into a workplace pension scheme are not increasing from April 2025. The contribution rates will remain the same for both employees and employers.

Note employees will receive a tax saving equivalent to 1% which reduces their overall cost to 4%.

It would be worth reminding your employees that if their income exceeds the higher rate tax threshold, they may be able to claim additional relief on their pension contributions.

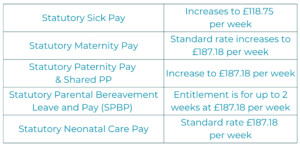

On 20th February 2025 HMRC issued guidance on Neonatal Care Pay.

This will give support to families by enabling them to be by their child’s side without having to work throughout or use up their existing leave. Neonatal Care Leave will apply to parents of babies who are admitted into neonatal care up to 28 days old and who have a continuous stay in hospital of 7 full days or longer.

These measures will allow eligible parents (those who meet continuity of service requirements and a minimum earnings threshold) to take up to 12 weeks of leave (and, if eligible, pay) on top of any other leave they may be entitled to, including maternity and paternity leave.

Please note that the employee thresholds will increase to:

The Postgraduate Loan threshold remains at £21,000.

When you are processing your payroll, where employment is subject to off-payroll working rules, student loan deductions should not be made. The worker will account for student loan obligations in their own tax return.

CALL US 01325 349700

Join our mailing list today for insights, events and webinars: