We are recruiting for the following position for our York office.

Type: Full Time/Permanent

Location: York

Who we are:

Clive Owen LLP is one of the largest independent firms in the North. With integrity and excellence at our core, our innovative use of technology and operations allows us to provide first-class service to our clients.

Role Summary:

Based in our growing York office, you will be reporting to a Tax Director or Partner, you will be involved in the delivery of tax compliance and advisory services for a portfolio of some of the most wealthy and exciting entrepreneurial businesses across our region. The delivery of your work will be supplemented using cutting-edge technology to enhance efficiencies and client delivery.

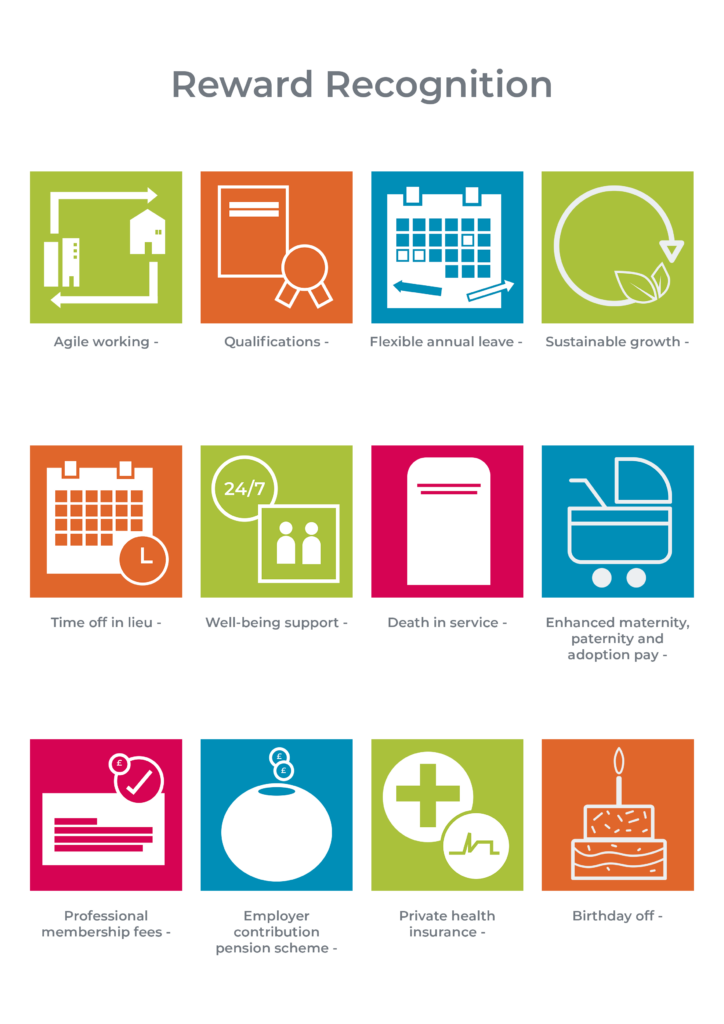

Our Perks:

Main Tasks and Responsibilities

- Review and prepare income tax and partnership tax returns and P11Ds from a variety of systems including CCH, Iris and Taxshield and providing feedback as appropriate

- Review work of and aid development of Taxation Associates

- Research more complex tax planning issues and assisting Tax Director or Partner with drafting tax advisory reports

- Deal with more complex cases around remuneration planning and capital gains tax, liaising with the client as appropriate with support from tax partners and directors

- Act as a point of contact for clients for ad hoc queries

- Attend client and external events where appropriate

- Attend clients’ sites or homes where required

- Actively participate in department meetings

- Undertake relevant CPD to maintain technical knowledge

The above list of duties is not exhaustive, and the post holder will be required to undertake such tasks as may reasonably be expected within the scope and grading of the role.

Person Specification:

Essential

- Fully ATT/CTA or equivalent qualified

- Relevant tax experience gained within practice

- Experience of using tax preparation software

- Have excellent written and verbal communication skills and be confident speaking to clients face to face, over the telephone and by email

- Must have excellent IT skills, including working knowledge of Excel

- The ability to check work for accuracy and have good attention to detail

- The ability to judge differing situations and respond accordingly

- Be flexible and proactive in managing multiple priorities

Desirable

- Proven experience of delivering excellent client service

- Experience of personal tax planning, residency, share schemes or inheritance tax

- Experience of corporation tax compliance.

- Working with People – demonstrates an interest in and understanding of others, adapts to the team and builds team spirit and listens, consults and communicates proactively

- Presenting and Communicating – provides written and verbal information clearly and confidently to the relevant audience

- Applying Expertise and Technology – applies specialist and detailed technical knowledge, uses technology to achieve work objectives and shares expertise and knowledge with others

- Analysing – ability to analyse and evaluate information to make rational judgements and produce workable solutions

- Planning and Organising – identifies priorities and develop specific goals and plans to accomplish objectives and meet deadlines required and manages time effectively

- Delivering Results and Meeting Client Expectations – focuses on client needs and satisfaction, sets high standards for quality and works in a systematic and methodical way

- Facing Challenges – works productively to meet competing priorities and maintains positive outlook

To apply for this role, click here: Application site

We are now very proud to be one of the largest independent firms in the region with exciting growth plan, and we are recognised as a Great Place To Work® as well as being accredited by the Good Business Charter.